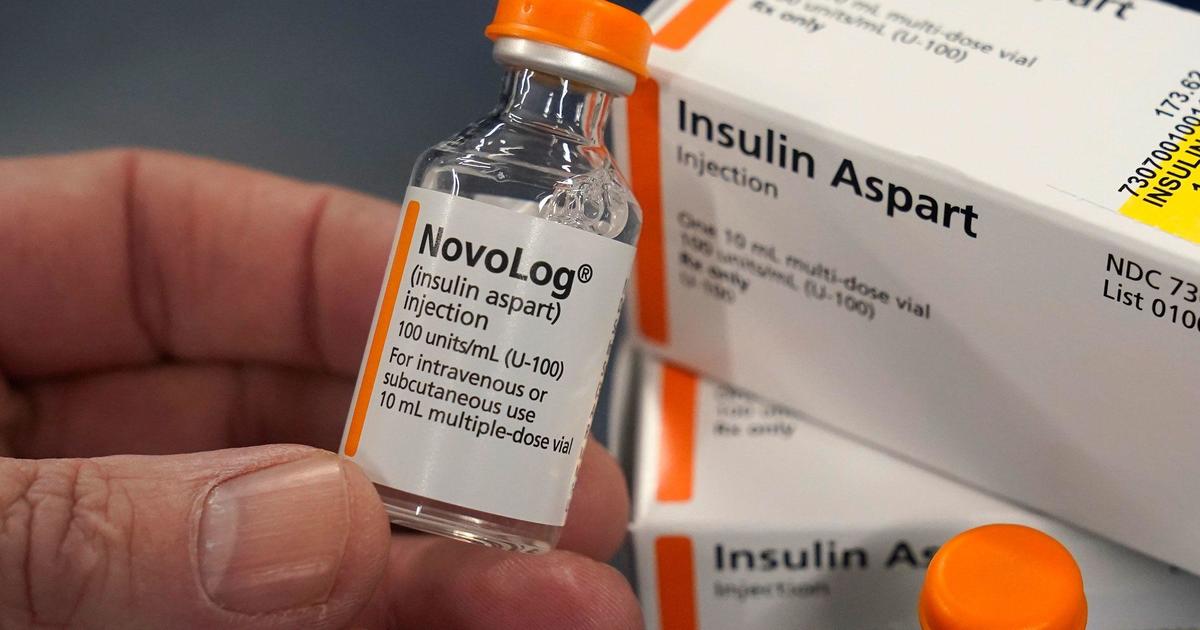

Federal regulators are accusing the country’s three largest pharmacy benefit managers of illegally driving up the cost of insulin in the U.S., while making it harder for patients to obtain cheaper versions of the life-saving drug.

The companies — CVS-owned Caremark Rx, Cigna Group’s Express Scripts and UnitedHealth Group’s Optum Rx — acted in ways that stifled industry competition for insulin drugs, including by using unfair rebating practices, the Federal Trade Commission said Friday.

That artificially raised the list price of insulin, creating what the agency characterized as a “drug rebate system that prioritizes high rebates” from drugmakers, the FTC alleged in announcing lawsuits against the three businesses and their affiliates.

Pharmacy benefit managers, known as PBMs, manage prescription drug plans for health insurance programs, including Medicare, and serve as intermediaries with pharmacies, employers and drugmakers. Caremark, Express Scripts and Optum together administer roughly 80% of all prescriptions in the U.S., according to the FTC.

“Millions of Americans with diabetes need insulin to survive, yet for many of these vulnerable patients, their insulin drug costs have skyrocketed over the past decade thanks in part to powerful PBMs and their greed,” Rahul Rao, deputy director of the FTC’s Bureau of Competition, said in a statement. “Caremark, ESI, and Optum — as medication gatekeepers — have extracted millions of dollars off the backs of patients who need life-saving medications.”

Patient advocates, lawmakers and other critics have long accused PBMs of driving up drug costs, though the companies say they help control health care expenses and pass along savings to their clients.

CVS Caremark and Optum disputed the FTC’s allegations.

“CVS Caremark is proud of the work we have done to make insulin more affordable for all Americans with diabetes. To suggest anything else, as the FTC did today, is simply wrong,” the company said in a statement to CBS News.

A CVS spokesperson also said the company has a record of protecting patients from rising prescription drug prices and that it has “led the way in driving down the cost of insulin for all patients.”

CVS members on average pay less than $25 for insulin, according the company, which added that it negotiates deep discounts for its clients.

Optum called the FTC’s claims “baseless.”

“For many years, Optum Rx has aggressively and successfully negotiated with drug manufacturers and taken additional actions to lower prescription insulin costs for our health plan customers and their members, who now pay an average of less than $18 per month for insulin,” the company said in a statement to CBS News.

Express Scripts said the FTC has chosen “to ignore the facts and score political points, rather than focus on its duty to protect consumers.”

Far higher costs in U.S.

Insulin costs have skyrocketed in the U.S. over the past two decades, putting the cost of care out of reach for many Americans. some of whom are forced to ration the drug or skip treatment.

Adjusted for inflation, between 2017 and 2022 the cost of insulin in the U.S. rose 24%, according to the American Diabetes Association. But the gross price of insulin is more than 900% higher on average in the U.S., compared with the cost in 33 developed economies around the world, according to a February RAND report.

Even after factoring in discounts from drugmakers, the cost of insulin in the U.S. was more than double that in comparable countries, the nonprofit think tank found.

“Insulin prices in the United States have been increasing for many years and are substantially higher than in other middle- and high-income nations,” Andrew Mulcahy, the study’s lead author and a senior health economist at RAND, said in the report.

—The Associated Press contributed to this report