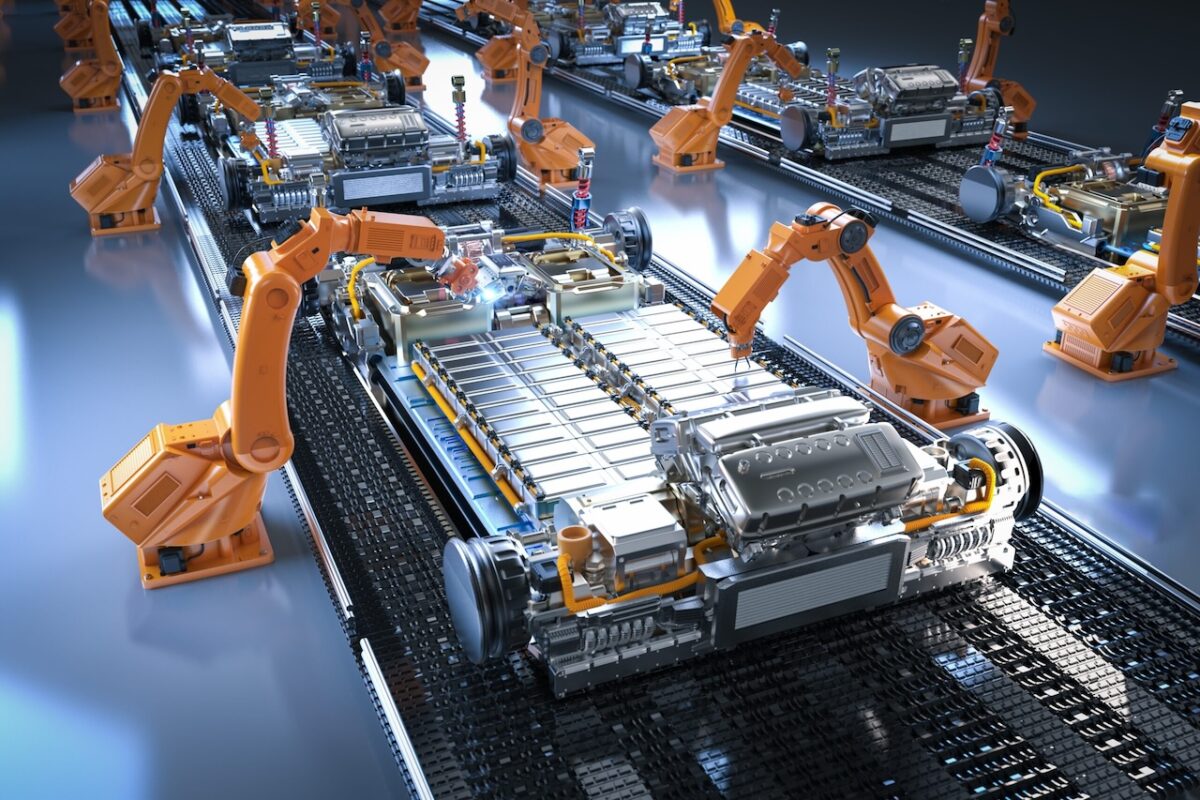

Quick and efficient cell inspection techniques could help battery makers survive the ramp-up period and minimise scrappage rates. By Stewart Burnett

Winning the general public’s trust in electric vehicles (EVs) will partially depend on the ability to demonstrate the safety and reliability of batteries. Battery problems are among the most common causes of vehicular failure in EVs, with consequences ranging from costly repairs to life-threatening fires. The latter can be extremely difficult to put out and generally lead to the loss of the entire vehicle.

However, minimising defect rates at the point of manufacture is not only crucial for consumer trust; it is also vital to ensure battery makers mitigate costly losses and maximise their production yields. Shawn Murphy, Founder and Chief Executive of battery technology firm Titan Advanced Energy Solutions (Titan), warns that first-year throughput yields for batteries can be as low as 10-20% as production ramps up. This issue is most acutely felt In the West, where battery makers must play catch-up with their counterparts in China, Korea, and Japan to serve local markets. A majority of battery factories in the West remain in either the early stages of production or have yet to be constructed.

Even when production enters full swing, however, defect rates can exceed 20% due to unaddressed system-level issues with production. To help ensure battery reliability and better production processes, Titan AES has developed a cell inspection system called IonSight, which uses ultrasound to inspect the batteries while still on the production line. So, how does it work, and how can it help OEMs maximise the reliability of their products?

Seeing problems directly

Titan describes its IonSight ultrasound imaging solution as the first real-time battery inspection system that can be integrated onto the production line. It can near-instantly map a cell’s morphology and identifying potential anomalies. “It can operate at the speed of production itself,” remarks Murphy to Automotive World. In practice, this means that quality control does not become a bottleneck.

Incumbent battery inspection solutions like open-circuit voltage and electrochemical impedance spectroscopy can often prove limited in what they detect. Instead of scanning the cell and looking for visual indicators of an anomaly, they measure a cell’s electrical parameters and use this as a basis for assessing a potential issue. “Electrochemical measurements will not tell you how much gas you have, or if dendrite formation is occurring. Neither will it tell you if you have lithium plating or a separator wrinkle,” explain Murphy. “All of these things impact the battery when it’s in use.”

Issues like lithium plating, a process that occurs when metallic lithium builds up on the surface of the anode, cannot be detected by electrochemical impedance spectroscopy. Reduced battery life, limited fast charging, and even thermal runaway can emerge as a result. Plating can also lead to the formation of dendrites, which might cause a battery to short irreparably. “With an incumbent solution, you would only realise problems like these when driving the car.”

The architecture of the imaging system is designed to prioritise both high resolution—between 250 and 400 microns in all directions—and speed. A cell can be scanned in its entirety in slightly more than half a second. IonSight processes as many as 50,000 cells per line per shift, which can theoretically be increased with the installation of additional inspection systems through parallelisation. One of the differentiators for Titan, claims Murphy, is that it can scan cells at a faster rate than they are produced: around 55 per minute.

Algorithm integration

Scanning the cell is only part of the equation—roughly another half second is also spent analysing a battery using Titan AES’ proprietary algorithms. As many as 60 to 70 algorithms can be running concurrently to analyse the data generated. “When we scan a battery, we can get anywhere between half a million to a million data points,” says Murphy. “We generally know more about any individual cell than any manufacturer possibly can achieve using incumbent methods.”

The unprecedented richness and volume of data that Titan’s proprietary ultrasound systems gather from every cell in production enforces stringent demands on signal processing and subsequent analytics execution. It is no surprise that nearly half of the company’s talented staff are data scientists and software engineers. Our approach has been to keep the architecture of the IonSight platform extremely resource-conscious, leveraging close-to-the-metal programming to assure efficiency and scalability. This creates an optimized data pipeline that converts analogue signals to actionable digital insights in real time.

Titan’s algorithms not only detect potential anomalies within the cell images but can also trace the anomalies to potential root causes through pattern recognition and a foundational knowledge of battery manufacturing processes. The insights generated during this process can then be used to drive production process optimisation, addressing problems at their source. This, in turn, leads to lower defect and scrappage rates and increased process yields, resulting in better overall end-of-line cell quality.

Playing catch-up

While an effective inspection system is key for all battery makers, Western markets may benefit disproportionately from it. For regulatory purposes, many automakers are looking to decouple themselves from China, which dominates battery production. In the US, for example, at least 50% of battery components’ value must be manufactured or assembled in North America if the automaker wants their EV to be eligible for consumer tax credits. Automakers failing to meet these criteria might suddenly find themselves at a competitive disadvantage.

At the end of the day, time is money, and money means survival

Murphy notes that China’s substantial lead in mastering EV battery production has allowed it to build knowledge and increase its throughput yield over time. It also benefits from heavy state subsidies and low labour costs. If Western battery makers cannot rein in their scrappage rates, it will be more difficult to compete on cost. A 50% scrappage rate, he warns, effectively doubles the price of battery production.

Western battery makers may even find it difficult to survive the ramp-up period if they cannot quickly gain control of their throughput yield and bring it into the optimal range of 88% or more. The defect rates in batteries that eventually reach consumers will also invariably be higher if effective inspection systems are not in place beforehand, likely damaging consumer trust in EVs.

Clearly, robust practices around battery inspection and reliability will be crucial for electrification to succeed in the West without relying on imports. While contractually bound not to name specific companies, Murphy claims Titan AES has received a substantial amount of attention for this reason. “We’ve really been taking off with these EU and US gigafactories because we can help them quickly identify both the defects and their root causes,” he emphasises. “At the end of the day, time is money, and money means survival.”