The Consumer Financial Protection Bureau (CFPB) on Thursday issued a rule to limit bank and credit union lending fees that it says will save consumers $5 billion annually.

The rule, which applies to the banks and credit unions with more than $10 billion in assets, gives these institutions three options: They can charge an overdraft fee of $5; charge a fee that covers their costs or losses; or continue to charge fees of any amount, so long as they disclose the terms of the overdraft loan and are compliant with lending laws.

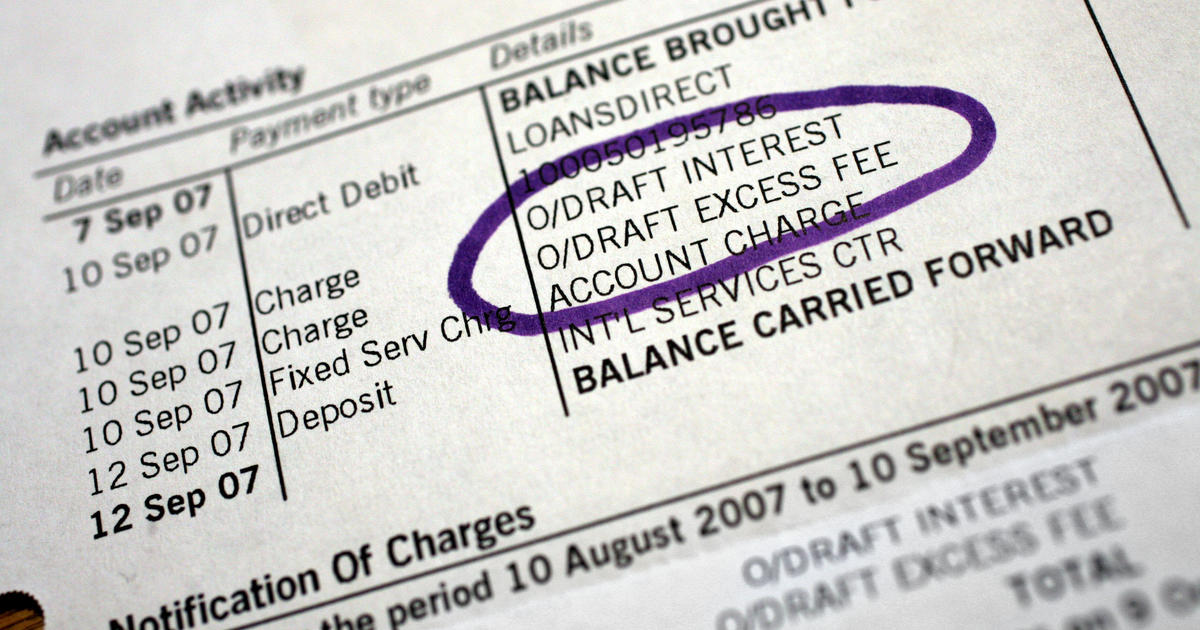

Banks can currently charge as much as they want in overdraft fees. On average, they charge around $35 each time a customer overdraws funds from their accounts, according to the CFPB.

The CFPB expects the rule to save consumers $5 billion annually in overdraft fees, or $225 per household that pays overdraft fees.

“For far too long, the largest banks have exploited a legal loophole that has drained billions of dollars from Americans’ deposit accounts,” CFPB Director Rohit Chopra said in a statement Thursday. “The CFPB is cracking down on these excessive junk fees and requiring big banks to come clean about the interest rate they’re charging on overdraft loans.”

The rule closes a legal loophole that allowed banks to bypass laws limiting how much they could charge consumers in overdraft fees. These fees have driven up consumer costs, and led to tens of millions of consumers losing access to banking services. Negative credit reporting has made it impossible for them to open other accounts, too, according to the CFPB.

Banks are expected to challenge the rule, which is set to take effect in October 2025.

It is part of the Biden Administration’s pledge to crack down on so-called unreasonable bank “junk fees.” The U.S. Department of Transportation has also taken steps to curb junk fees charged by airlines.

The U.S. PIRG on applauded the CFPB’s move, saying that previously banks had penalized those who could least afford to pay overdraft fees, and that the law protects their most vulnerable customers.

“In practice, overdraft fees have functioned as high-cost credit, so it only makes sense to regulate excessive fees as such. The CFPB’s rule makes overdraft fees more reasonable and in line with the actual costs to banks,” PIRG’s Consumer Campaign Director Mike Litt said in a statement.

National Economic Council director Lael Brainard said in a statement that “for too long, excessive overdraft fees have saddled hardworking Americans with charges that really add up, preventing them from getting ahead.”

“The CFPB’s new rule, which caps overdraft fees as low as $5, is expected to save many families as much as $225 a year. That is real relief for families,” she said.

The banking industry, however, is expected to challenge the rule, which the American Bankers Association accuses of “demonizing highly regulated and transparent bank fees.” The advocacy group said the rule “will make it significantly harder for banks to offer this valuable service to their customers, including those who have few other options to cover essential payments.”

TD Cowen analysts say they expect the rule to face legislative, regulatory and legal challenges. The savings to consumers will come at the expense of revenue for banks, particularly regional lending institutions, according to the analysts.