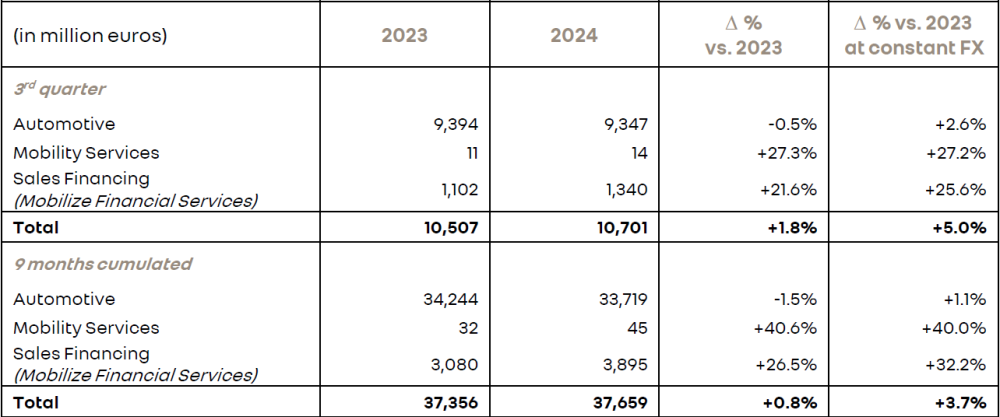

Group revenue at €37.7 billion, +0.8% vs 2023 9m, +3.7% at constant exchange rates

- 2024 9-months:

- Group revenue at €37.7 billion, +0.8% vs 2023 9m, +3.7% at constant exchange rates[1]

- Auto revenue at €33.7 billion, -1.5% vs 2023 9m, +1.1% at constant exchange rates[1]

- 2024 Q3:

- Group revenue at €10.7 billion, +1.8% vs 2023 Q3, +5.0% at constant exchange rates[1]

- Auto revenue at €9.3 billion, -0.5% vs 2023 Q3, +2.6% at constant exchange rates[1]

- Continuous improvement in the product mix effect at +3.8 points

- Strong automotive brands:

- Renault brand #3 in Europe, #1 in LCVs[2], #1 in France. Clio #2 best-selling car across all channels in Europe

- Dacia #9 in Europe passenger cars (PC) and on the podium of European PC retail sales. Sandero #1 best-selling car across all channels in Europe

- Alpine achieved a high double-digit growth year‑to‑date, before product offensive

- Solid orderbook in Europe at around 2 months of forward sales, reflecting the sound order intake and ahead a strong Q4

- Disciplined management of total inventory level: 528ku at September 30, 2024 (down 14ku yoy)

- Renault Group confirms its 2024 financial outlook:

- A Group operating margin ≥7.5%

- A free cash flow ≥€2.5bn

“Our Q3 revenue is starting to benefit from our unprecedented product offensive, with 10 new launches this year, representing 18% of our invoices over the quarter. This trend will continue over the next quarters in line with the gradual introduction of vehicles on their respective markets and will accelerate further with the 7 new launches planned for 2025.

This appealing and competitive line-up, with both electric and ICE & hybrid vehicles, demonstrates our flexibility to adapt whatever the pace of EV transition and remains a key support for the Group’s performance together with cost reduction.

In this challenging environment, we are accelerating our in-depth transformation with committed teams, to improve our agility and build our next chapter“ said Thierry Piéton, Chief Financial Officer of Renault Group.

[1] In order to analyze the variation in consolidated revenue at constant exchange rates, Renault Group recalculates the revenue for the current period by applying average exchange rates of the previous period.

[2] Light Commercial Vehicles, excluding pick-up trucks.

Third quarter revenue

Group revenue for 2024 Q3 amounted to €10,701 million, up 1.8% compared to 2023 Q3. At constant exchange rates[1], Group revenue was up 5.0%.

Automotive revenue reached €9,347 million, down -0.5% compared to 2023 Q3. It included -3.1 points of negative exchange rates effect (-€289 million) mainly related to the devaluation of the Argentinean peso, the Brazilian real and to a lesser extent to the Turkish lira. At constant exchange rates[1], it increased by 2.6%. This evolution was mainly explained by the following:

- A stable price effect of +0.2 points, as expected, reflecting the entry into a phase of price stabilization. Renault Group aims to offset negative currency by pricing actions while giving a portion of its cost reduction back to its customers mostly through content. Thereby, it further supports the competitiveness of the Group’s vehicles while protecting margins.

- A positive product mix effect of +3.8 points explained by the first benefits of Renault Group’s new models’ ramp-up across Renault (Scenic E-Tech electric, Symbioz, Rafale) and Dacia (Duster) brands. This gradual improvement compared to the previous quarters of the year will continue in line with the Group’s dynamic launches.

- A slightly negative geographic mix of -1.2 points, explained by the ramp-up of Kardian in Brazil and penalized by the weaker registrations in France and Germany over the quarter.

- A negative volume effect of -3.1 points with a 5.6% decrease in registrations which was partially offset by a lower destocking of the independent dealer network over the quarter compared to 2023 Q3 (destocking by 93k units in 2023 Q3 and 72k units in 2024 Q3). This destocking, while still significant, is back in line with regular seasonal patterns for a third quarter.

- A negative sales to partners effect of -2.1 points, reflecting a transition year before the launches of new vehicles for Renault Group’s partners, starting with the New Nissan B‑segment electric vehicle in 2025.

- A positive ”Other” effect of +5.0 points, primarily related to the solid performance of Retail Renault Group (RRG) activity and parts and accessories.

Mobility Services contributed €14 million to 2024 Q3 Group revenue compared to €11 million in 2023 Q3.

Mobilize Financial Services posted revenue of €1,340 million in 2024 Q3, up 21.6% compared to 2023 Q3, due to higher interest rates and to the increase of average performing assets (at €56.5 billion) which improved by 8.5% compared to 2023 Q3.

As of September 30, 2024, total inventories (including the independent network) represented 528,000 vehicles (down 14,000 units year-on-year):

- Group inventories at 231,000 vehicles

- Independent dealer inventories at 297,000 vehicles

The level of total inventories at the end of September was in line with the normal seasonal evolution and the ramp-up in the Group’s new products launches. Furthermore, it is supported by a sound orderbook at around 2 months of forward sales at the end of September.

2024 FY financial outlook

Renault Group confirms its 2024 FY financial outlook:

- Group operating margin superior or equal to 7.5%

- Free cash flow superior or equal to €2.5bn

Commercial results highlights

In the first nine months of 2024, Group’s sales were stable compared to the same period in 2023 with 1,637,225 vehicles sold (-0.4%). In Europe[2], the Group sold 1,175,762 vehicles (+3.1%) and grew faster than the market (+1.8%). All Group’s brands contributed to the growth (Renault brand up 3.5%, Dacia up 2.2% and Alpine up 17.5%), and outperformed the market.

In 2024 Q3, the Group’s worldwide sales reached 482,468 vehicles (-5.6%). In Europe[2], in a market down -6.1%, the Group registered 328,111 vehicles (-5.3%) and confirmed its 3rd position with a 9.8% market share. Renault Group’s sales were up and outperformed the market in Italy (+16.6%), Spain (+11.9%) and the United Kingdom (+11.4%), partially offsetting a lower activity in France and Germany. Outside Europe, the Group’s registered 150,217 vehicles (-5.8%).

Renault brand pursued its growth over the first nine months of 2024 with 1,126,560 vehicles sold worldwide. It grew in its main markets:

- In Europe[2], the brand was ranked 3rd with sales reaching 740,314 units, up 3.5% which represented a 6.6% market share. Renault brand’s sales rose notably in Italy (+16.2%), Spain (+10.6%), the United Kingdom (+24.3%) and France (+1.1%), where Renault confirmed its market leadership. Renault Clio, whose sales in Europe rose by 5.6%, moved up 3 places to become the 2nd best-selling model across all channels. The brand consolidated its leadership in the European LCV market, excluding pick-ups, with sales up 9.9%.

- Outside Europe, thanks to its International Game Plan 2027, Renault brand’s sales were up 6.0% in Brazil, benefitting from the successful launch of Renault Kardian, and were up 3.9% in Türkiye with the start of the New Renault Duster.

In 2024 Q3, Renault brand’s sales totalled 339,307 units, down -4.9%. In 2024 Q4, Renault brand will benefit from the ramp-up of its numerous launches, addressing both the European and the international markets.

Dacia sold 500,957 vehicles worldwide in the first nine months of 2024, representing a 1.5% growth compared to the same period in 2023. In Europe[2], with 432,332 vehicles sold (+2.2%), the brand moved up 2 places in the Passenger Car (PC) market to rank 9th. It consolidated its position on the European PC retail sales podium, the brand’s core customer base. Dacia recorded notably strong performances in Italy (+15.0%) and Spain (+14.6%). It maintained a solid 3rd place on the French PC market in a context of line-up renewal with the arrival of All‑New Duster and New Spring. Dacia Sandero, with sales up 16.3% in the first nine months of 2024, is Europe’s #1 best‑selling model across all channels.

In 2024 Q3, the brand’s performance was down (-3.8%) with 142,431 vehicles sold. This is explained by the transition between the Spring and Duster generations. The very good level of orders for All-New Duster confirms the positive outlook for the coming quarters.

Alpine sold a total of 3,333 A110 in the first nine months of 2024. It represented a 16.5% growth compared to the previous year. The mix was particularly high with more than 80% of vehicles sold on high trim versions. In Europe, the brand grew in its main markets: +21.5% in France, +19.5% in Germany and +17.6% in the United Kingdom.

Alpine is off to a good start in terms of orders for its new A290 model, a hot hatch which will arrive in dealerships in France during the 4th quarter. The brand will also open three new stores, bringing the total number of Alpine Stores worldwide to 160.

A commercial strategy focused on value that continues to deliver results. In 2024 Q3:

- Retail sales accounted for 67.8% of the total number of vehicles sold in the Group’s five main European countries (more than 23 points above the market), up versus the first two quarters of 2024. The Group had 4 vehicles in the top 10 retail sales rankings in Europe: Sandero, Duster, Clio and Captur. In Europe, the Renault brand sold more than one in every two sales to retail customers, and Dacia reached an 85% share of its sales on retail.

- In C-segment and above, the Renault brand accelerated (42.4% of brand sales, up 1.6 points), driven in particular by Austral and Espace E-Tech Full hybrid, which high-trim versions were the most popular, and before benefitting from the effects of Scenic E-Tech electric, Symbioz and Rafale.

Electrified vehicles accounted for 30.2% of Renault Group’s PC sales in Europe (+3.4 points compared to the same period in 2023). This performance was explained by the very strong growth in hybrid sales which were up +52.4% compared to the same period in 2023.

Renault brand’s electrified vehicles accounted for 46.8% of its PC sales in Europe (+7.8 points compared to the same period in 2023). The brand continued to grow on this market, with a market share of 7.4%, up 1.0 point. Renault brand ranked 2nd on the hybrid vehicle market in Europe.

All-electric vehicles accounted for 7.6% of Renault Group’s PC sales in Europe (and 11.6% for Renault brand PC sales). This was down, as expected, in a year of transition marked by the discontinuation of Zoe and Twingo electric and the generation transition of Dacia Spring. Renault Group is launching a full range of electric vehicles symbolized by Scenic E-Tech electric, Renault 5 E-Tech electric, Alpine A290, New Dacia Spring, Renault 4 E-Tech electric and Alpine A390, which will support Renault Group’s EV penetration.

Renault Group’s sales in 2024 Q4 will be strengthened by the progressive deployment of 7 new vehicles across European countries: Renault 5 E-Tech electric, New Renault Captur, Renault Symbioz, New Renault Master (awarded International Van Of The Year 2025), New Dacia Spring, All-New Dacia Duster and Alpine A290. Outside Europe, Renault brand’s sales will be boosted by the first full quarter of sales of Kardian in Latin America, New Renault Duster in Türkiye and Grand Koleos in South Korea. The latter is off to an excellent start in the country.

Renault Group’s consolidated revenue

Renault Group’s top 15 markets at the end of September 2024

[1] In order to analyze the variation in consolidated revenue at constant exchange rates, Renault Group recalculates the revenue for the current period by applying average exchange rates of the previous period.

[2] Scope : ACEA Europe.

SOURCE: Renault Group